Most people think their therapy copay is the full cost. You see $30 on your insurance card, assume that’s what you’ll pay each week, and budget accordingly. But that $30 is just the tip of the iceberg. If you don’t understand the full picture-deductibles, coinsurance, out-of-pocket limits, and network rules-you could end up paying thousands more than expected. And it’s not just about money. It’s about avoiding surprise bills, stress, and even quitting therapy because you can’t afford it.

What Your Copay Doesn’t Tell You

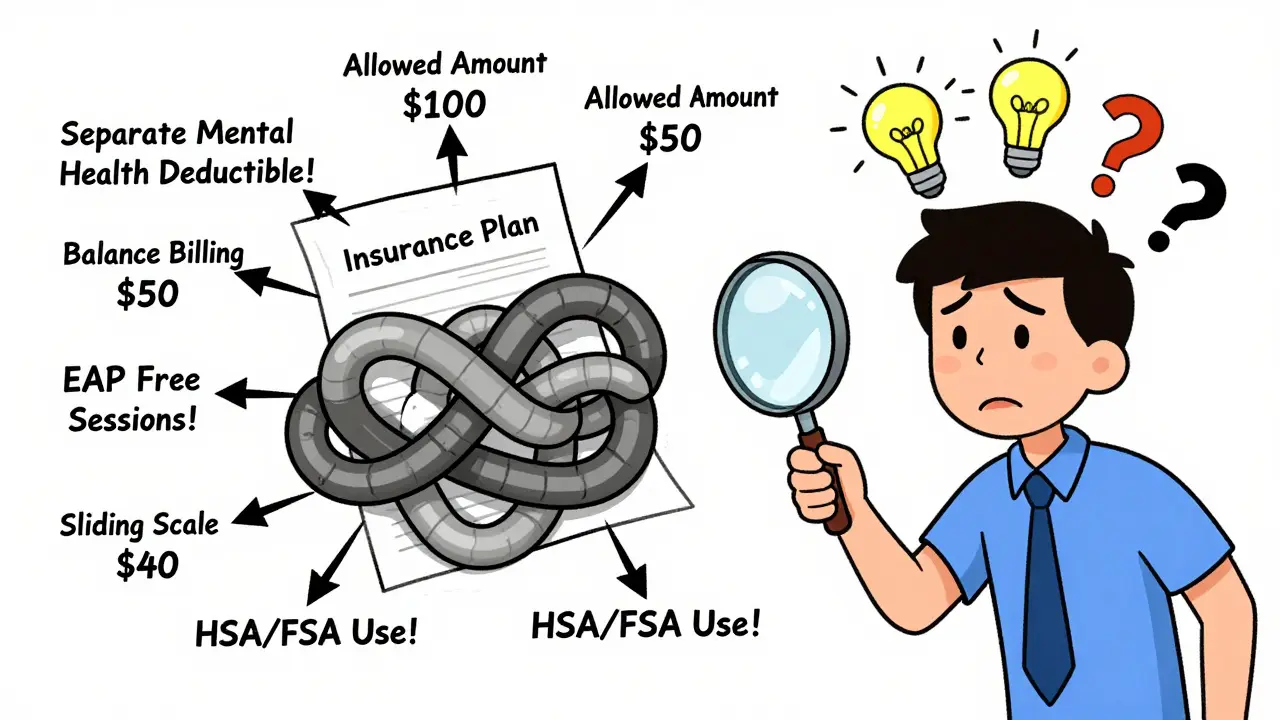

Your copay is the fixed amount you pay per session after you’ve met your deductible. But if you haven’t met your deductible yet, you pay the full session rate. That’s the first thing most people miss. For example, let’s say your therapist charges $125 per session and your deductible is $1,500. That means you pay $125 per session until you’ve paid $1,500 out of pocket. At $125 per session, that’s 12 sessions before your insurance starts helping. If you’re seeing your therapist weekly, you’ll hit that deductible in about three months. By then, you’ve already spent $1,500-just on therapy. Your $30 copay hasn’t even kicked in yet. And if your plan has a separate mental health deductible? That’s even worse. Some plans treat therapy as a completely separate category from medical care. So even if you’ve paid $5,000 toward your general medical deductible, your therapy deductible might still be $1,500. You’re paying full price again. No one tells you this upfront.Deductibles, Coinsurance, and Allowed Amounts

Once you hit your deductible, coinsurance kicks in. That’s the percentage you pay of the “allowed amount”-what your insurance says the service is worth, not what your therapist charges. Say your therapist charges $125, but your insurance’s allowed amount is only $100. You have 20% coinsurance. You pay 20% of $100, which is $20. But if your therapist charges $150 and your allowed amount is still $100? You pay $20 coinsurance plus $50 in balance billing. That’s $70 out of pocket. And not all therapists accept the allowed amount. Out-of-network providers often don’t. That’s why you need to ask: “What’s your allowed amount for this service?” Thriveworks’ 2024 data shows the average therapy session without insurance is $143.26. With insurance, it can range from $20 to $70 per session, depending on your plan. But those numbers only apply after you’ve paid your deductible. Before that? You’re paying full price. That’s why a $30 copay can turn into a $1,500 bill in three months.In-Network vs. Out-of-Network: The Hidden Cost Split

Choosing an in-network therapist isn’t just about convenience-it’s about money. In-network providers have agreed to your insurer’s allowed amounts. Out-of-network providers don’t. That means you pay more. If you go out-of-network, you often pay the full session fee upfront. Then you submit a claim. Your insurer reimburses you based on their allowed amount, not what the therapist charged. Let’s say you pay $175 for a session. Your insurer’s allowed amount is $120. You get 60% reimbursement: $72. You’re out $97. That’s $67 more than if you’d picked an in-network provider with a $30 copay. Alma’s 2023 analysis found out-of-network patients pay 40-50% of the session cost after deductible, compared to 20-30% for in-network. That’s a huge difference over 20 sessions. And if you’re in a high-cost area like New York or North Dakota, where sessions average $176-$227, that gap gets even wider.The Out-of-Pocket Maximum: Your Safety Net

There’s a limit to how much you’ll ever pay in a year. For 2024, the federal cap is $9,350 for individuals and $18,700 for families. This includes all your deductibles, copays, and coinsurance for in-network services. Once you hit that cap, your insurance pays 100% of covered therapy costs for the rest of the year. That’s huge-if you need long-term care. Let’s say you need 30 sessions at $125 each. That’s $3,750 total. But if your deductible is $1,500 and coinsurance is 20%, here’s the math:- First 12 sessions: $125 × 12 = $1,500 (deductible met)

- Next 18 sessions: 20% of $100 allowed amount = $20 per session × 18 = $360

- Total out-of-pocket: $1,860

Medicare, Medicaid, and Other Plans

If you’re on Medicare, therapy is covered at 80%. You pay 20% of the allowed amount. For a $143 session, that’s about $28.65. But if you have Original Medicare, you’ll need a Medigap Plan G to cover that 20%. Plan G costs $120-$200/month. So your total monthly cost becomes $28.65 + $150 = $178.65. That’s more than your copay-but still less than paying full price. Medicaid usually has little to no copay. But not all therapists accept it. You’ll need to find providers who do. For private insurance, always check your plan documents. Look for sections titled “Mental Health Benefits,” “Cost Sharing,” or “Out-of-Pocket Expenses.” Don’t rely on your insurance app. Call them. Ask: “What’s my mental health deductible? Is it separate from my medical deductible? What’s my coinsurance rate? What’s my out-of-pocket maximum?”Sliding Scale, Clinics, and Alternatives

If you’re uninsured or underinsured, you’re not stuck. About 42% of private therapists offer sliding scale fees based on income. That can cut your cost by 30-50%. You’ll need to provide proof of income, but many don’t require tax forms-just a quick conversation. Open Path Collective offers sessions for $40-$70 to uninsured people. University training clinics, run by grad students under supervision, charge 50-70% less than private practices. Some charge as little as $15-$30 per session. These aren’t “second-best” options. They’re legitimate, effective, and often used by people who can’t afford the standard rate. But you have to look for them. Don’t assume therapy is only for people with good insurance.How to Build Your Real Therapy Budget

Stop guessing. Start calculating. Here’s how:- Find your plan type: Is it copay-only? Deductible-based? Coinsurance? Check your summary of benefits.

- Know your numbers: Deductible? Coinsurance rate? Out-of-pocket maximum? Allowed amount for therapy?

- Estimate sessions: Most people need 12-16 sessions for improvement. For complex issues like PTSD or chronic depression, 15-20+ is common.

- Calculate Phase 1 (pre-deductible): Full session cost × sessions until deductible is met.

- Calculate Phase 2 (post-deductible): Copay or coinsurance × remaining sessions.

- Add it up: Phase 1 + Phase 2 = your estimated annual cost.

- Check the cap: If your total exceeds your out-of-pocket maximum, you’ll pay less.

- Phase 1: 12 sessions × $125 = $1,500 (deductible met)

- Phase 2: 8 sessions × $40 = $320

- Total: $1,820

Pro Tips to Reduce Your Costs

- Time your therapy: Start therapy right after your insurance year resets (January 1). That gives you a fresh deductible.

- Combine services: If you’re seeing a doctor for migraines or back pain, those visits count toward your mental health deductible if they’re under the same plan. Use them.

- Use employer resources: EAPs (Employee Assistance Programs) often offer 3-6 free sessions. Use them before you start paying.

- Track everything: Keep receipts. Save emails from your insurer. Use a spreadsheet. You’ll need it if you dispute a bill.

- Ask for a payment plan: Many therapists offer monthly payment options. Don’t assume they don’t.

What Most People Get Wrong

Nearly 40% of patients don’t know their copay until after their first session, according to Shasta Health. That’s because insurance apps show “copay” without explaining it’s only after deductible. They don’t show the full picture. People also assume their insurance “covers therapy.” That’s not the same as “covers it affordably.” Coverage means they pay part. Not all. Not always. And no one talks about transportation, time off work, or childcare. Those add up. A $30 session with a 45-minute commute and $20 parking? That’s $50. And if you’re seeing your therapist weekly, that’s $2,600 a year in hidden costs.Final Thought: Know Your Numbers Before You Start

Therapy is one of the most effective investments you can make in your life. But it shouldn’t break you. The cost isn’t hidden-it’s buried in fine print. You just have to dig. Call your insurer. Ask the questions. Write down the answers. Do the math. Use a free tool like Alma’s Cost Estimator or Rula’s calculator. Don’t wait until you’re $2,000 in debt because you thought your copay was the whole story. You deserve to heal. But you also deserve to know what it will cost.Is my therapy copay the only thing I pay?

No. Your copay is only what you pay after you’ve met your deductible. Before that, you pay the full session rate. You may also pay coinsurance (a percentage of the allowed amount) after your deductible, and you could owe extra if your therapist charges more than your insurer allows.

What’s the difference between in-network and out-of-network therapy?

In-network therapists have agreed to your insurer’s allowed amounts, so you pay less-usually just a copay or coinsurance. Out-of-network therapists don’t, so you pay the full fee upfront and then get reimbursed a percentage of the insurer’s allowed amount, which is often lower than what you paid. This can leave you paying significantly more.

Do all therapy visits count toward my deductible?

It depends. Some plans have a single deductible for all medical services, including therapy. Others have separate deductibles for mental health. Always check your plan documents or call your insurer to confirm whether your therapy visits count toward your medical deductible or a separate mental health one.

How do I know if I’ve met my deductible?

Log into your insurer’s member portal and look for your “Explanation of Benefits” or “Benefits Summary.” It should show how much you’ve paid toward your deductible this year. If you can’t find it, call customer service and ask: “How much of my deductible have I met for mental health services?”

Can I use my HSA or FSA to pay for therapy?

Yes. Therapy is a qualified medical expense under both Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs). You can use these funds to pay for copays, coinsurance, or full session fees-even before your deductible is met. This is a smart way to reduce your out-of-pocket costs with pre-tax dollars.

What if I can’t afford therapy even with insurance?

Many therapists offer sliding scale fees based on income. You can also use services like Open Path Collective, which connects uninsured people with therapists charging $40-$70 per session. University training clinics often offer sessions at 50-70% off. Don’t give up-there are options if you ask.

Dec, 17 2025

Dec, 17 2025

Moses Odumbe

December 17, 2025 AT 21:17Carolyn Benson

December 19, 2025 AT 04:19Meenakshi Jaiswal

December 19, 2025 AT 20:11bhushan telavane

December 20, 2025 AT 05:06holly Sinclair

December 20, 2025 AT 14:38Emily P

December 20, 2025 AT 17:56Vicki Belcher

December 21, 2025 AT 10:15Alex Curran

December 22, 2025 AT 01:03Lynsey Tyson

December 23, 2025 AT 02:04Edington Renwick

December 24, 2025 AT 05:19Allison Pannabekcer

December 25, 2025 AT 08:50anthony funes gomez

December 26, 2025 AT 09:17Sahil jassy

December 27, 2025 AT 22:09