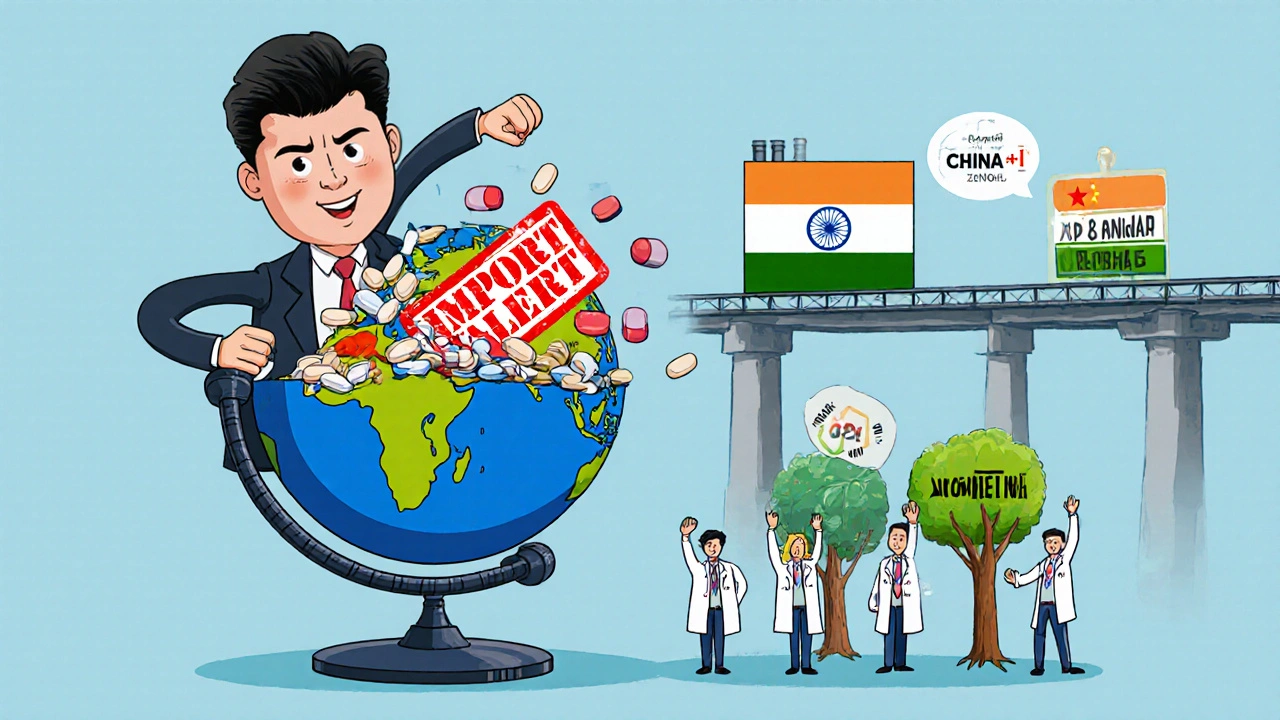

When you take a pill for high blood pressure or an antibiotic, chances are it was made in either China or India. These two countries supply the world with most of its generic drugs and active pharmaceutical ingredients (APIs). But behind the low prices and steady supply lies a complex reality: China and India face very different risks when it comes to drug quality-and the FDA watches them in completely different ways.

Why FDA Monitoring Matters More Than You Think

The U.S. Food and Drug Administration doesn’t just approve drugs-it inspects the factories that make them. Every year, FDA inspectors travel to hundreds of manufacturing sites around the world. Their job? To catch contamination, data fraud, poor sanitation, or sloppy quality controls before those drugs reach your medicine cabinet. In 2023, 37% of Chinese pharmaceutical facilities received import alerts from the FDA. That means the FDA blocked shipments because they didn’t meet safety standards. For Indian facilities, that number was just 18%. That’s not a small gap-it’s a 100% higher risk of regulatory trouble in China. These aren’t hypotheticals. In 2022, the FDA shut down a major Chinese API plant after finding unapproved chemicals mixed into raw materials. In the same year, an Indian facility was cited for missing documentation-but fixed it within weeks. The difference? One was a systemic failure. The other was a paperwork glitch.India’s Edge: Compliance Over Cost

India has over 100 FDA-approved drug manufacturing plants. China has 28. That’s not a typo. India leads the world in the number of facilities cleared for U.S. markets. Why? Because Indian manufacturers have spent decades building systems that match FDA rules. They train staff on 21 CFR Part 211-the FDA’s exact quality standards. They use digital tracking to log every batch, every test, every temperature reading. Bain & Company found that Indian firms have added digital interventions across plants to eliminate human error. That’s not marketing speak-it’s what keeps inspectors from writing Form 483s, the official notices of violations. Indian companies also know the language. English is widely spoken in pharma hubs like Hyderabad and Ahmedabad. Regulatory teams speak the same terms as FDA inspectors. Communication gaps? Minimal. This is why global drugmakers use the "China+1" strategy. Instead of relying only on China, they add India as a backup. It’s not about cheaper labor-it’s about reliability. One U.S. procurement executive told Bain & Company: "We’d rather pay a little more for India because we don’t have to double-check every shipment."China’s Strength: Scale, Not Standards

China controls about 80% of the world’s generic API supply. That’s not just a lot-it’s a monopoly. If you’re making a common drug like metformin or amoxicillin, the raw ingredient likely came from China. The cost advantage is real. Manufacturing APIs in China is 40% cheaper than in the U.S. or Europe. But that’s where the benefit ends. Quality control is inconsistent. Smaller factories in China still cut corners. Some use unapproved solvents. Others skip stability testing. The FDA’s inspection reports show Chinese plants get more observations for data integrity issues-like backdating lab results or deleting failed tests. China’s government has tried to fix this. Since 2018, it’s pushed factories to meet WHO-GMP and ISO standards. Some large players like Sinopharm and CSPC have upgraded. But thousands of smaller suppliers? Many haven’t. And the FDA doesn’t care if a plant is "mostly" compliant. One violation can trigger a full import alert.

The Hidden Weakness in India’s Model

Here’s the uncomfortable truth: India depends on China for its own drug supply. In 2024, 72% of India’s bulk drug ingredients came from China. That’s up from 66% just two years earlier. So while India makes the final pills, China makes the core chemical. That’s a single point of failure. If China restricts exports-or if a factory gets shut down by the FDA-India’s entire supply chain trembles. One U.S. pharmaceutical executive put it bluntly: "We’re outsourcing our risk. We think we’re safe with India, but we’re still buying the foundation from China." India knows this. That’s why the government launched a $3 billion "Make in India" program to build domestic API production. The goal? Cut that 72% dependency to under 40% by 2030. But building API plants takes years. And right now, China still owns the pipeline.What the FDA Actually Sees

FDA inspection data from 2020 to 2023 shows Indian facilities received 30% fewer Form 483 observations than Chinese ones. That’s the real metric. It’s not about how many plants are approved-it’s about how often they mess up. Chinese facilities are more likely to be flagged for:- Unapproved starting materials

- Missing batch records

- Unreliable water systems (a major source of contamination)

- Manual data entry with no electronic backup

- Minor documentation delays

- Outdated training logs

- Labeling errors

Nov, 12 2025

Nov, 12 2025

Chrisna Bronkhorst

November 13, 2025 AT 19:52Eve Miller

November 15, 2025 AT 12:06Amie Wilde

November 15, 2025 AT 16:19Gary Hattis

November 16, 2025 AT 21:47Erica Cruz

November 18, 2025 AT 14:38Johnson Abraham

November 19, 2025 AT 12:28Shante Ajadeen

November 21, 2025 AT 03:46Deepa Lakshminarasimhan

November 21, 2025 AT 05:38Esperanza Decor

November 22, 2025 AT 14:43Danae Miley

November 24, 2025 AT 03:55dace yates

November 25, 2025 AT 16:52